Barcelona must settle £50m Premier League transfer debt to avoid fresh financial crash

Barcelona faces a critical financial juncture that could set the stage for more chaos in 2026 unless urgent action is taken to settle outstanding transfer debts. The infamous debt pile, particularly a £50 million obligation tied to Premier League transfers, threatens to plunge the La Liga giants into turmoil once again. Recent developments have underscored the fragile state of the Catalan club’s finances, pushing management to navigate a labyrinth of payments and budget constraints just to maintain their competitive edge.

The scale of Barcelona’s financial struggles

Barcelona’s fiscal woes have been well-documented over the past several years. Despite remaining La Liga champions, the club’s financial health has deteriorated sharply. The 2025/26 season kicked off with registration hurdles largely stemming from budget overspends and restrictions imposed due to lingering debts. This precarious situation shows just how tight the margins have become and how critical it is to resolve legacy financial obligations to avoid greater sanctions or a possible financial crash.

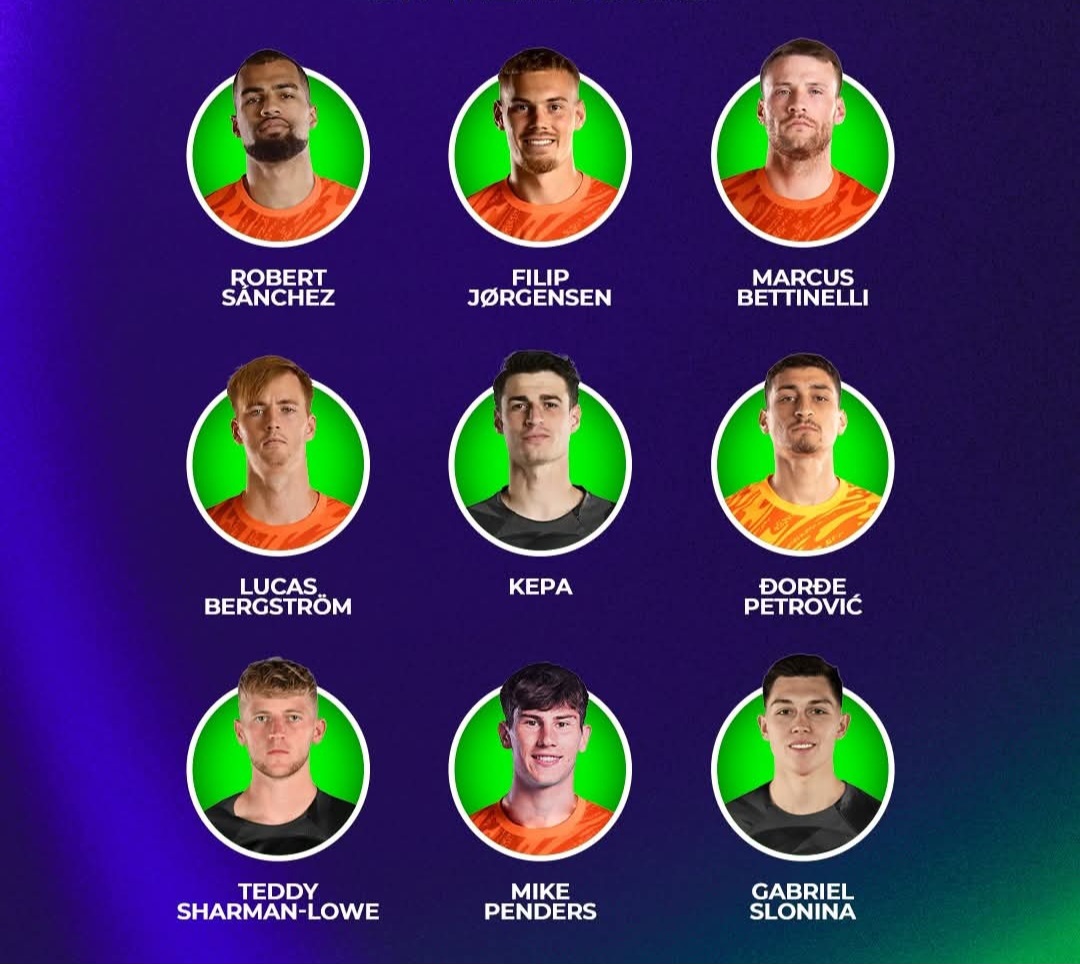

One of the unique workarounds recently employed was leveraging the “salary space” freed up by an injury to club captain Marc-Andre ter Stegen. His absence allowed Barcelona to register summer signing Joan Garcia, but this was a temporary fix that masks deeper structural issues.

Transfer debts and registration crises: a ticking time bomb

Undoubtedly, one of the significant contributing factors to Barcelona’s financial nightmare is the legacy of enormous transfer fees and payment schedules stretching over multiple years. Key high-profile deals from previous transfer windows have yet to be fully settled. These deferred payments strain the club’s liquidity and complicate efforts to meet La Liga’s financial fair play regulations.

A notable breakdown of outstanding fees includes the nearly £22 million owed to Sevilla for Jules Kounde and £8.5 million still due to Bayern Munich for Robert Lewandowski’s transfer. These smaller yet substantial amounts contribute to the overall financial pressure.

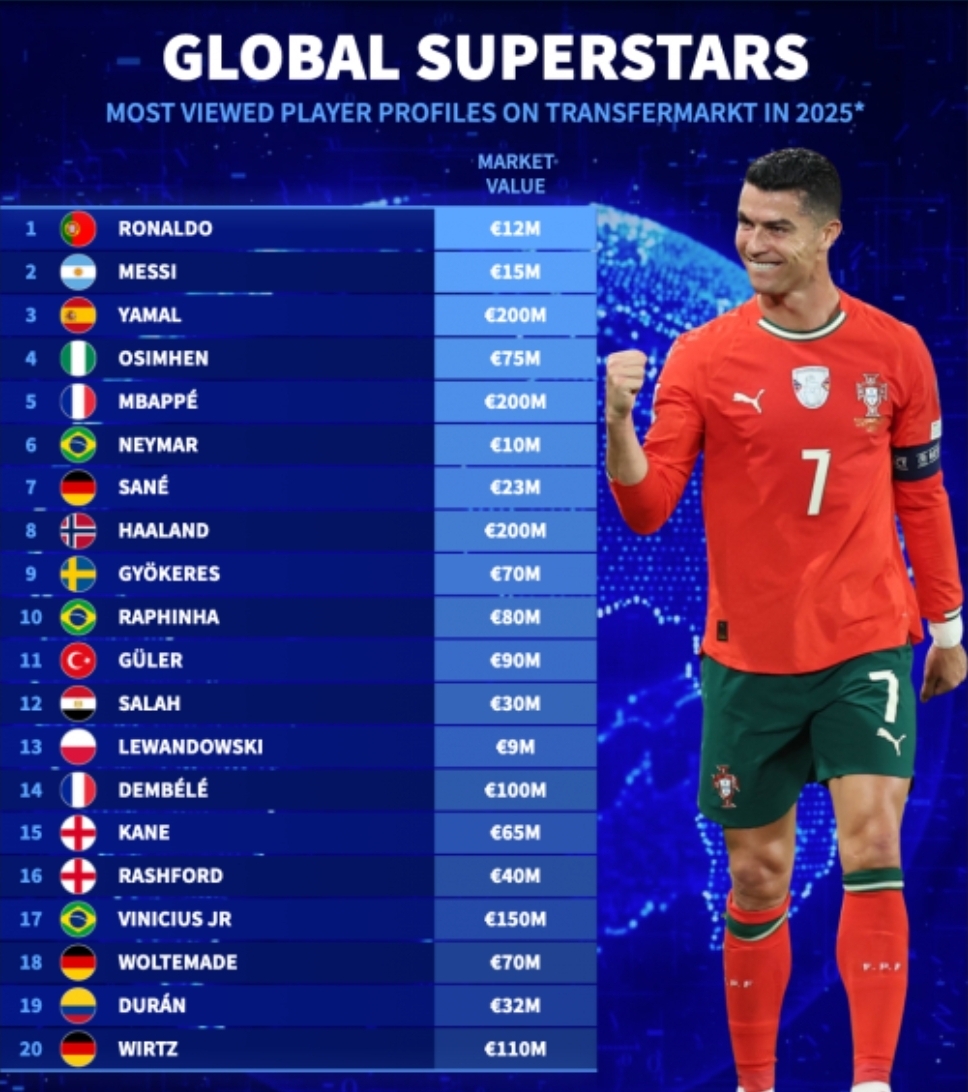

However, the most alarming shortfall comes from Premier League transfers, specifically relating to Raphinha and Ferran Torres’ moves to Leeds United and Manchester City respectively. The combined debt from these deals has now swelled to over £50 million with accrued interest, exacerbating the risk of a new financial crisis.

The urgency to settle the £50m Premier League transfer debt

In light of the situation, Barcelona’s hierarchy has relayed to club members the necessity of settling at least £121 million of their transfer debt by the end of the 2025/26 season. The total transfer excess currently stands at an astonishing £138 million, making this a gargantuan task.

This large-scale repayment plan is part of a cautiously approved budget designed not only to manage current expenditures but also to chip away at the structural transfer debt. Failure to meet these obligations risks triggering severe budget restrictions or sanctions by La Liga authorities, potentially hampering player registrations, contract extensions, and new signings.

Strategic sales, loans, and future financial manoeuvres

Barcelona has resorted to a multi-pronged strategy to address this financial quagmire. The club has pushed for several player sales and loan agreements to reduce the wage bill and generate immediate funds. For example, Marcus Rashford’s loan move has required complex paperwork and contract extensions before finalizing his registration. Bayern Munich’s coach Hansi Flick has expressed interest in retaining Rashford permanently; however, the £30 million activation fee will demand further financial juggling.

Moreover, these maneuvers indicate that the club plans to keep negotiating staggered payments to debt holders, gradually eroding the pile of inherited transfer fees. This “piecemeal payment” approach seems essential to prevent another fiscal collapse while maintaining on-field competitiveness.

Looking ahead: What does the future hold for Barcelona?

Barcelona’s ongoing efforts to recalibrate their finances and reduce transfer debts must succeed to avoid a repeat of past financial crises. With £50 million owed to Premier League clubs alone already casting a shadow over their future, the club’s stability will hinge on diligent financial management and successful sales or loan deals in upcoming windows.

Failure to control these debts could lead to restrictions on player registrations or even bans on new signings, stalling Barcelona’s ambitions both at home and in Europe. The club’s ability to remain competitive while navigating these financial storms will undoubtedly test the effectiveness of its new administrative strategies.

Conclusion

Barcelona’s current financial landscape is a testament to the dangers of unchecked spending in modern football. The urgent need to settle the £50 million Premier League transfer debt, alongside other outstanding dues, underscores the tightrope walk that the club must perform over the next season. Through careful debt management, strategic squad changes, and strict budgeting, Barcelona aims to steer clear of a fresh financial crash and reclaim its position among Europe’s elite—providing crucial lessons for football clubs worldwide on fiscal discipline and sustainability.