Saudi Crown Prince Considering €10 Billion Offer for Barcelona: What It Could Mean for the Club

Saudi Crown Prince Mohammed bin Salman is reportedly considering making a staggering €10 billion offer to buy Barcelona, according to recent reports from El Chiringuito. This potential move aligns with Saudi Arabia’s ongoing commitment to investing heavily in global sports, aimed at increasing its international influence and diversifying its economy beyond oil. The mere possibility of such an enormous bid has sparked widespread discussion among football fans, analysts, and sports economists alike.

Understanding the Context: Why Barcelona?

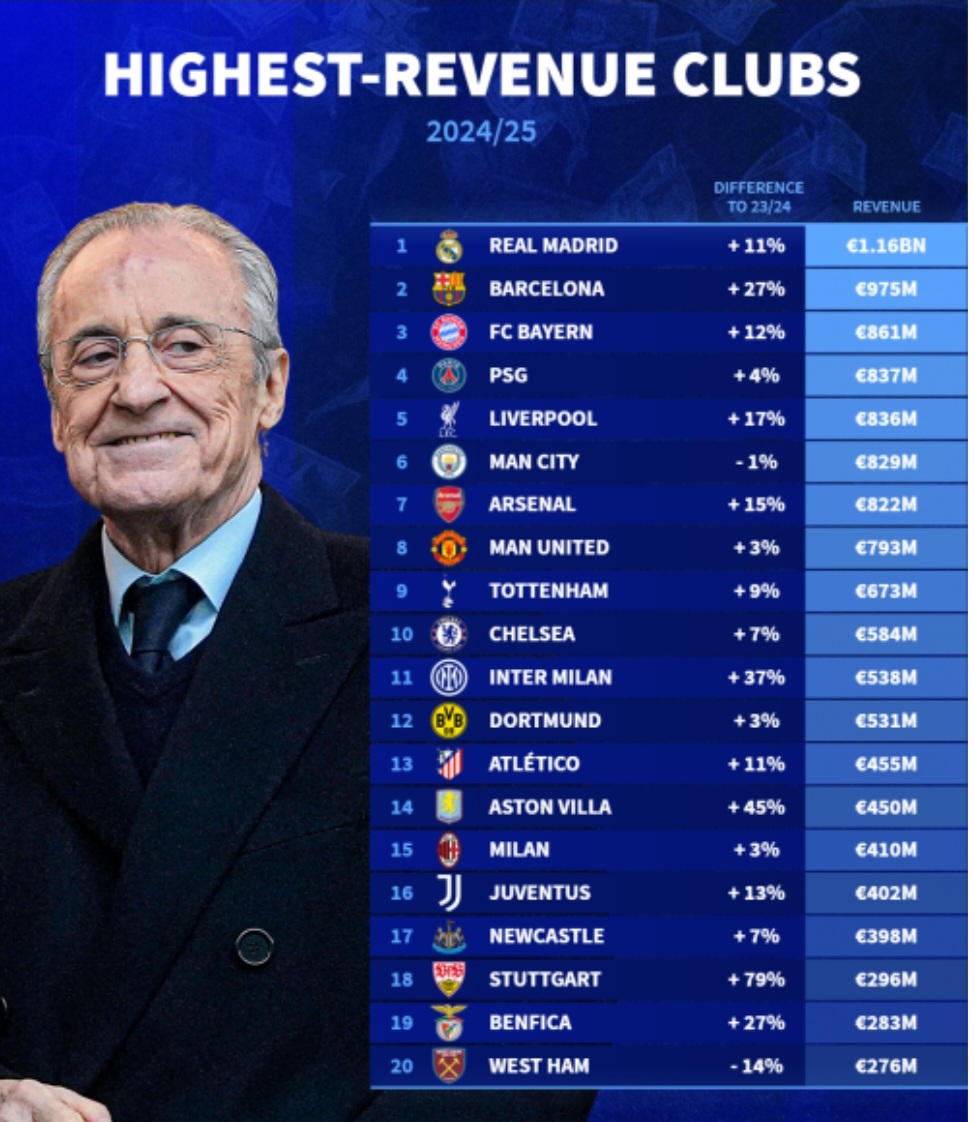

Barcelona, one of the most storied football clubs in the world, is currently grappling with significant financial challenges. The club’s debt is estimated to exceed €2.5 billion, a burden that has placed serious constraints on its ability to attract top talent and stabilize operational expenditures. This financial fragility presents an appealing opportunity for external investors with deep pockets.

The Crown Prince’s interest is not a standalone phenomenon—it fits within a broader strategic framework. Saudi Arabia has increasingly pursued ownership and sponsorship deals in various parts of the sports world. This includes investments through its Public Investment Fund (PIF), which owns stakes in multiple sports franchises globally. Acquiring or investing in a high-profile club like Barcelona would further cement the kingdom’s position in international sports.

Barcelona’s Ownership Structure: A Major Hurdle

Despite the impressive nature of the potential €10 billion bid, experts and insiders alike agree that a full takeover of Barcelona remains highly unlikely. Unlike many football clubs owned by private investors or corporate entities, Barcelona is owned by its socios—member shareholders who have historically resisted foreign ownership.

The socios have a deep cultural and emotional attachment to the club, prioritizing tradition and collective ownership over commercialization. This democratic structure makes any outright sale to a foreign entity extremely complicated. Transformation of ownership would require substantial changes to governance statutes and unanimous support from the membership base, which is currently improbable.

Saudi Arabia’s Alternative: Strategic Investment Without Control

While a full acquisition might be out of reach, there is potential for significant Saudi investment in the club’s commercial or entertainment branches. Such investments could include partnerships in merchandising, broadcasting, digital platforms, or even stadium-related ventures. These areas offer high revenue potential without threatening the club’s cultural identity.

Moreover, a strategic minority investment could also pave the way for collaborations that improve financial health while respecting club governance. This would align with recent trends in sports where wealthy investors seek financial participation without complete control, balancing profit with tradition.

The Broader Sports Investment Narrative

Saudi Arabia’s push into global sports is part of a broader vision to diversify its economy and enhance international stature. Besides football, the kingdom has invested in Formula 1, golf, boxing, and wrestling events, often sponsoring lucrative tournaments and acquiring minority interests in clubs and leagues.

The proposed €10 billion offer for Barcelona symbolizes a new scale of ambition. Even if it does not culminate in ownership, it highlights the shifting landscape of sports finance, where sovereign wealth funds and government-backed investment vehicles play an increasingly influential role.

Implications for Barcelona and European Football

For Barcelona, such interest—whether resulting in a takeover or not—shines a spotlight on the chronic financial issues plaguing many European football clubs. It underscores the need for sustainable financial management and innovative revenue generation to compete in a rapidly evolving market.

At the same time, the reported bid raises questions about the future of club ownership models in Europe. Could foreign investment challenge the traditional socio ownership of historic clubs? Might hybrid models become more common as clubs seek capital but wish to retain cultural control?

The answers remain uncertain, but it is clear that football is entering a new era where financial power dynamics are rapidly changing, with entities like Saudi Arabia’s Public Investment Fund leading a new wave of global sports engagement.

Conclusion

The reports of Saudi Crown Prince Mohammed bin Salman considering a €10 billion bid for Barcelona underline the ongoing transformation in global sports investment. While a full purchase seems improbable due to Barcelona’s unique socio ownership structure, the possibility of strategic investment or partnerships remains on the table. This development not only reflects Saudi Arabia’s ambitions but also highlights the pressing financial challenges and evolving governance models facing one of football’s biggest clubs. Fans and stakeholders alike will be watching closely as this story unfolds, knowing that its outcomes could ripple across the entire footballing world.## Saudi Crown Prince Considering €10 Billion Offer for Barcelona – What It Means for the Club and Global Sports

Saudi Arabian Crown Prince Mohammed bin Salman is reportedly considering a €10 billion offer to acquire Barcelona, according to the widely followed sports outlet El Chiringuito. This surprising development has sparked intense debate across football and investment communities, highlighting the intersection of sports, finance, and geopolitics on a global stage. The proposed bid reflects Saudi Arabia’s growing ambition to expand its influence in international sports through massive investments, particularly via its sovereign wealth vehicle, the Public Investment Fund (PIF).

Understanding the Context Behind the Offer

Barcelona’s financial struggles have been well documented in recent years. The club faces debts exceeding €2.5 billion, aggravated by the COVID-19 pandemic’s impact and years of overspending. Despite being one of the most successful and iconic football clubs worldwide, the Blaugrana’s economic hardships have created vulnerabilities that have drawn attention from potential investors looking for lucrative opportunities in European football.

The Crown Prince’s interest is aligned with Saudi Arabia’s broader strategy to diversify its economy and enhance its global soft power. By investing billions of euros in prestigious sports entities and entertainment companies, Saudi leadership aims to raise the kingdom’s profile and build a dynamic, sport-centered entertainment hub in the Middle East. Previous ventures include acquiring stakes in major football clubs and hosting high-profile sporting events, signaling an aggressive push toward global sports prominence.

Why Barcelona’s Structure Makes a Full Takeover Unlikely

Despite the allure of Barcelona’s brand and the reputed €10 billion valuation cited in the reports, a full takeover of the club by the Saudi Crown Prince remains highly improbable. Barcelona operates under a unique ownership model where the club is owned by its socios members.