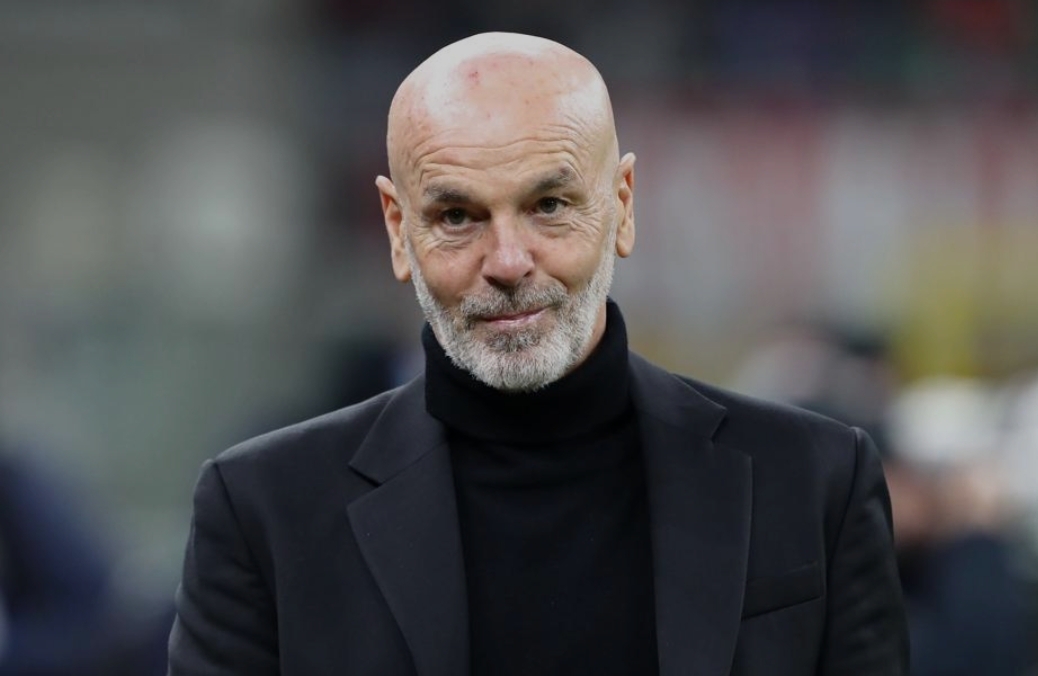

Milan Post Record Third Consecutive Profit with Revenues Near €500m

Milan have achieved a historic milestone by posting a profit for the third consecutive year, reinforcing their position as one of the financially strongest clubs in Europe. According to the latest report by Calcio e Finanza, the Rossoneri closed the 2024-25 financial year with record revenues nearing €500 million and a net profit of €3 million. This unprecedented financial performance marks the first time in the club’s 125-year history that it has recorded a surplus for three straight years, highlighting the effectiveness of their business strategy and sporting success.

Record Revenues and Transfer Gains Propel Growth

The club’s turnover surged by an impressive 10% compared to the previous season, driven primarily by Milan’s participation in the revamped UEFA Champions League. The new format introduced more home matches and an enhanced revenue distribution system, significantly boosting the club’s income from broadcasting rights and matchday earnings. This competitive edge on the European stage was a key factor in pushing Milan’s revenues close to the €500 million mark.

Beyond Champions League revenues, Milan also generated substantial capital gains from player transactions during the year. The sales of Tijjani Reijnders to Manchester City and Pierre Kalulu to Juventus provided significant influxes of cash, contributing directly to the club’s overall profitability. These strategic player sales reflect Milan’s ability to develop talent and manage the transfer market effectively, ensuring both on-field success and financial stability.

Financial Stability Despite Absence from European Competition

The 2024-25 season was notable not only for its financial successes but also for the fact that Milan achieved these results without participating in European competitions. Despite the absence of this crucial revenue stream, the club still managed to close the fiscal year with net assets totaling €199 million. This solid financial foundation offers Milan a strong buffer and security as they look forward to future seasons.

Such resilience is largely attributed to prudent financial management coupled with a clear long-term vision. Avoiding excessive debt and maintaining positive cash flow have been critical in stabilizing the club’s economic health during a season when revenue from Europe was temporarily unavailable.

RedBird’s Reinvestment and Long-Term Strategic Vision

Integral to Milan’s robust financial standing is the role played by the club’s ownership group, RedBird Capital. Since acquiring the club, RedBird has demonstrated a commitment to sustainable growth by reinvesting every euro generated. In the last two financial years alone, the investment surpassed €250 million gross, allocated across various key areas including the first team, the youth sector, and the Milan Futuro project, which focuses on infrastructural and developmental advancements.

This substantial reinvestment underpins Milan’s ambition to build a competitive squad capable of sustainable success while nurturing young talent through the youth academy. Moreover, it reflects an ownership philosophy that balances short-term competitiveness with long-term financial prudence.

The Stadium Project: Cornerstone of Milan’s Future Growth

Looking ahead, one of Milan’s primary strategic focuses is the ambitious new stadium project in partnership with Inter Milan. The plan to build a modern stadium at the iconic San Siro site is seen as the cornerstone of the club’s long-term growth strategy. This project is expected to transform matchday experiences, generate significant additional revenue streams, and enhance Milan’s brand and commercial appeal worldwide.

The stadium vision encapsulates Milan’s broader goal of solidifying its status as a top-tier global football club not only through sporting achievements but also through infrastructural innovation. By creating a state-of-the-art venue, Milan aims to elevate fan engagement, increase matchday income, and attract premium sponsorship deals in the years to come.

Conclusion

Milan’s financial results for the 2024-25 season, highlighted by a third consecutive net profit and record revenues near €500 million, set a new benchmark for the club’s economic health. The milestone results were fueled by strategic participation in the Champions League, astute player sales, and a strong ownership reinvestment policy under RedBird Capital. Despite the absence of European competition, Milan demonstrated remarkable resilience, closing the year with significant net assets.

As the club embarks on the next phase of its journey with an exciting new stadium project, Milan is well-positioned to combine on-field excellence with sustainable financial growth. This integrated approach promises to keep the Rossoneri among the elite clubs both in Italy and globally for years to come.